Web Content Viewer

Web Content Viewer

SAMSUNG

Galaxy AI is here

Now also available onGalaxy S23 Series, Z Flip 5 | Z Fold5, Tab S9 | S9+ | S9 Ultra

Order Now

SAMSUNG

Galaxy S24 Series

Galaxy AI is here. Unleash whole new levels of creativity, productivity and possibility

Order Now

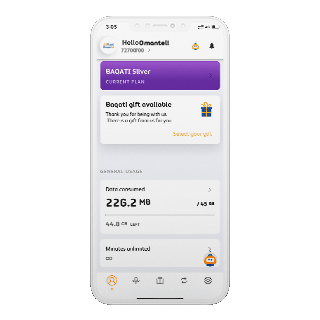

OMANTEL APP

Better than ever

Enjoy a whole new experience with enhanced features, easy top up, fast bill payment, gift cards and so much more.

Download the App